Planning for Big Purchases: A Guide to Financial Success

Big purchases can be exciting, whether it’s a new car, a dream vacation, or a home renovation project. However, without proper planning, these purchases can quickly become a financial burden. To ensure that your big purchases are a source of joy rather than stress, it’s essential to have a solid plan in place. In this guide, we’ll walk you through the steps to effectively plan for big purchases and achieve financial success.

1. Define Your Goals

The first step in planning for big purchases is to clearly define your goals. Take some time to think about what you want to achieve with this purchase. Are you looking for a practical solution, an upgrade, or a luxury item? Understanding your goals will help you make informed decisions throughout the planning process.

Consider the purpose, timeline, and budget for your purchase. Will it be a one-time expense or an ongoing investment? Set realistic expectations and determine how this purchase fits into your long-term financial goals.

2. Assess Your Financial Situation

Before making any big purchase, it’s crucial to assess your current financial situation. Take a close look at your income, expenses, and savings. Evaluate your debt and credit score. Understanding your financial standing will help you determine how much you can afford to spend and whether you need to make any adjustments to your budget.

Consider your monthly cash flow and how the big purchase will impact it. Will you need to make sacrifices in other areas of your life to accommodate this expense? It’s essential to be realistic about what you can comfortably afford without jeopardizing your financial stability.

3. Create a Budget

Once you have a clear understanding of your financial situation, it’s time to create a budget specifically for your big purchase. Start by estimating the total cost of the purchase, including any associated expenses such as taxes, insurance, or maintenance.

Next, review your income and expenses to determine how much you can allocate towards the purchase each month. Consider setting aside a portion of your income specifically for this purpose. If necessary, explore ways to cut back on non-essential expenses to free up additional funds.

Having a dedicated budget for your big purchase will ensure that you stay on track and avoid overspending. It will also help you determine a realistic timeline for achieving your goal.

4. Research and Compare

Before making any significant purchase, it’s essential to do thorough research and comparison shopping. Take the time to explore different options, brands, and models. Consider reading reviews and seeking recommendations from trusted sources.

Compare prices from different retailers or service providers to ensure you’re getting the best deal. Don’t be afraid to negotiate or ask for discounts. Remember, the more informed you are, the better equipped you’ll be to make a wise purchasing decision.

5. Consider Financing Options

If you’re unable to pay for the big purchase outright, it’s important to explore financing options. Research different lenders, banks, or credit unions to find the best interest rates and terms. Consider factors such as repayment period, monthly installments, and any associated fees.

Before committing to any financing option, carefully review the terms and conditions. Ensure that you understand the total cost of borrowing and any potential risks involved. If possible, try to save up for a larger down payment to reduce the amount you need to finance.

6. Prioritize Saving

In addition to budgeting and financing, it’s crucial to prioritize saving for your big purchase. Set up a separate savings account specifically for this goal. Automate regular contributions to ensure that you’re consistently saving towards your target amount.

Consider exploring different savings strategies, such as setting aside a percentage of each paycheck or redirecting windfalls or bonuses towards your savings. The more you can save upfront, the less you’ll need to rely on financing options, reducing the overall cost of your purchase.

7. Review and Reevaluate

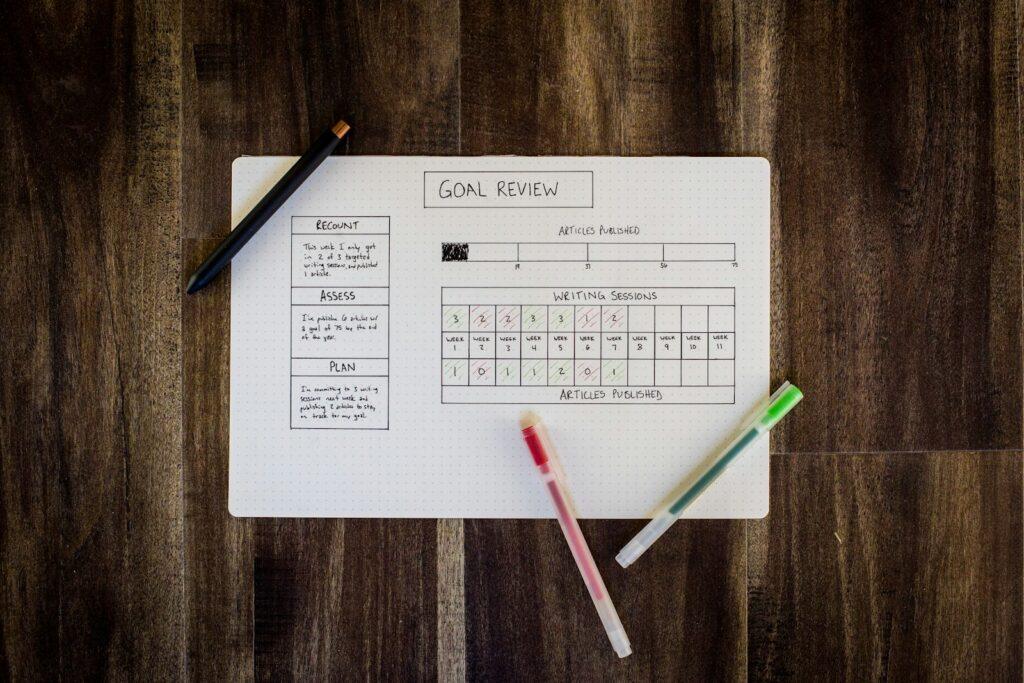

Throughout the planning process, it’s important to regularly review and reevaluate your goals and progress. Keep track of your savings, budget, and any changes in your financial situation. Adjust your plan as necessary to stay on track.

Be open to reassessing your goals and priorities. If circumstances change, it’s okay to modify your plans or adjust your timeline. The key is to maintain a proactive approach and remain flexible while working towards your big purchase.

Conclusion

Planning for big purchases is a critical step towards financial success. By defining your goals, assessing your financial situation, creating a budget, researching and comparing options, considering financing, prioritizing saving, and regularly reviewing your progress, you can ensure that your big purchases align with your long-term financial goals.

Remember, patience and discipline are key. With careful planning and smart financial decisions, you can achieve your big purchase goals while maintaining financial stability and peace of mind.